In this article, we will see the steps to open a recurring deposit account in HDFC Bank Online. Recurring Deposit or RD is a special type of deposit offered by most of the banks as a safest investment option where people can deposit a fix amount of money every month for certain period of time and after the completion they can get the amount with interest given by the bank. This act as an another steady source of income for all those peoples who are looking for a comparatively safer option to invest.

The rate of interest would be depending on the time you are opening the account as it always varies. But it will always be more than the interest you receive in your Savings bank account. You can always check the HDFC Bank current rate of interest and calculate your return on the deposit from here. As per the current given information, you can open invest amount as small as Rs1000(and in the multiples of 100 thereafter) or as large as Rs. 1,99,99,900 per month.

You can open for a minimum tenure of 6 months upto a maximum tenure of 10 years. It is not just available for domestic users but NRIs can also open but minimum tenure for them is 12 months. It can be opened offline as well as online. Most people with Netbanking prefer to open it online as it is very easy and convenient to open and manage the account online. Here we will also see the steps to open recurring deposit account in HDFC Bank online only.

How to Open a Recurring Deposit Account in HDFC Bank Online?

Also Read: How to Open a Recurring Deposit in Bank of India(BOI) Online?

Step 1: Prerequisites

a) You should have a valid saving bank account in HDFC Bank.

b) You should have a valid HDFC net banking account.

c) You should have valid credentials to login to your account.

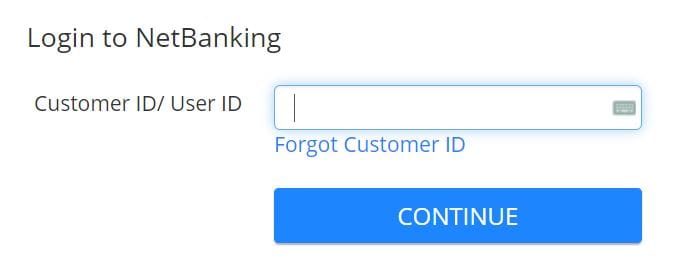

Step 2: Login to Your Account

In the first step, you need to visit HDFC Netbanking official website and provide your Customer ID/User ID to login. Then click on Continue.

Next you need to provide the Password/IPIN as shown below.

If you have security id set, then verify that id by selecting the This is my secure ID checkbox. Finally click on Login.

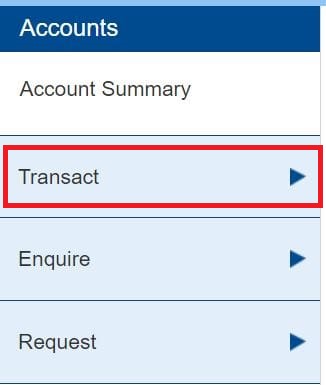

Step 3: Open a Recurring Deposit

After login successfully, you need to click and expand Transact option under Accounts on the left hand side as highlighted below.

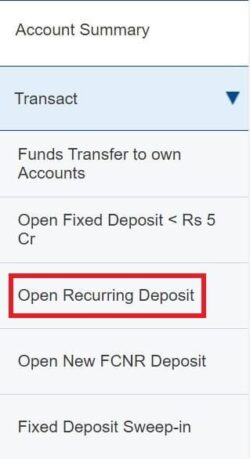

Then you need to select Open Recurring Deposit option as shown below.

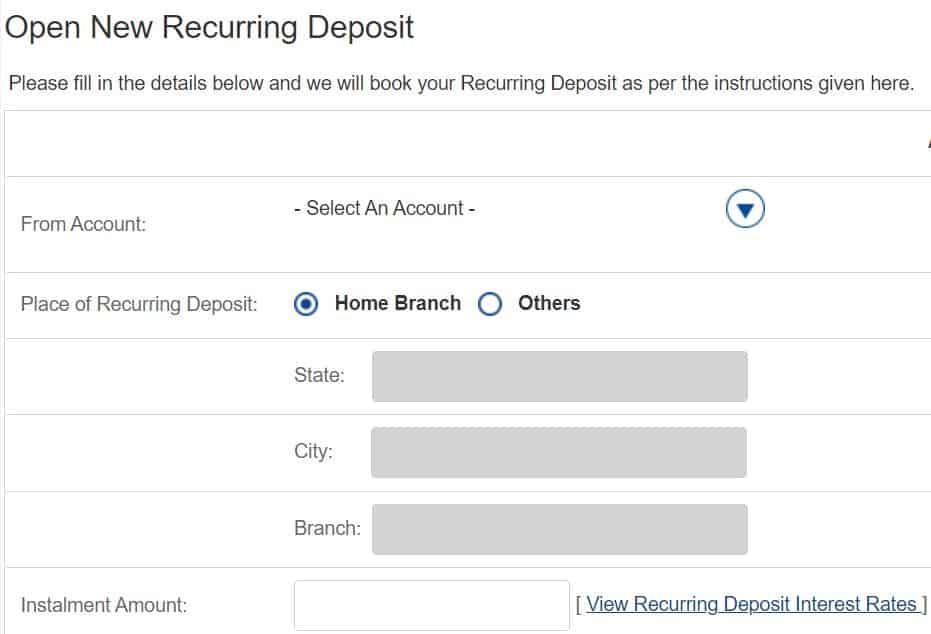

You will be redirected to below Recurring Deposit form where first you need to select your savings bank account from where the amount needs to be deducted every month till the deposit period. Then you need to select the Place of Recurring deposit from Home Branch or Others. By default Home Branch will be selected but if you are looking to change the place of deposit then you need to select Others and provide the branch details. Next you need to fill the installation amount that you would like deposit every month.

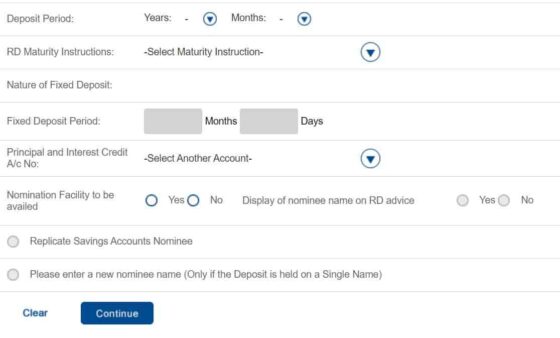

If you scroll down a bit, you will see an option to fill the Deposit Period. You can select the period in both years as well as in months. Then select appropriate RD Maturity Instruction as per your requirement. Next you need to provide the account details where maturity amount needs to be credited post completion of tenure. Finally if you would like, you can also fill the nomination details. After filling all the details, click on Continue to proceed.

You will see the summary of all the details given along with the final amount and the rate of interest given on the deposit amount. If everything looks ok then click on Confirm to finally open the fixed deposit account. You will see a Congratulatory message on successful opening of the Recurring deposit account. You can check the details in the Recurring deposit summary in Enquire section under Accounts. It will be updated there with all the details shown. That's all you needed to do.