In this article, we will see the steps to open a Fixed Deposit Account in HDFC Bank Online. Fixed deposit is known to be a safest investment option with guaranteed return after an agreed tenure completion. It is also a favorite investment option for peoples with salaried income due to no risk involved. HDFC offers fixed deposit in flexible time period ranging from 7 days to 10 years depositing an amount as low as Rs5000. You can also request to break your deposit anytime you want and get the principal amount with the interest accumulated. Hence providing you an option to liquidate whenever required.

It's not just convenient but advantageous also as the bank offers overdraft facility as well on your deposit. There are other bunch of features you can find on HDFC official website that can help you understand the benefits of opening a fixed deposit account. You can fixed deposit offline as well as online but it is much easier to open through netbanking. Here we will see the steps to open a fixed deposit in HDFC through online mechanism only.

How to Open a Fixed Deposit Account in HDFC Bank Online?

Also Read: How to Open a Fixed Deposit Account in Bank of India(BOI) Online?

Step 1: Prerequisites

a) You should have a valid saving bank account in HDFC Bank.

b) You should have a valid HDFC net banking account.

c) You should have valid credentials to login to your account.

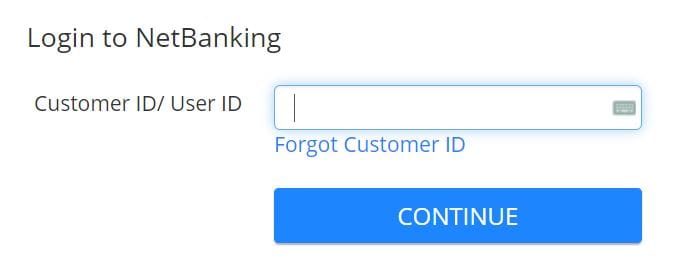

Step 2: Login to Your Account

In the first step, you need to visit HDFC Netbanking official page and provide your Customer ID/User ID to login. Then click on Continue to proceed.

Next you need to provide the Password/IPIN as shown below.

If you have security id set, then verify that id by tick marking This is my secure ID option. Finally click on Login.

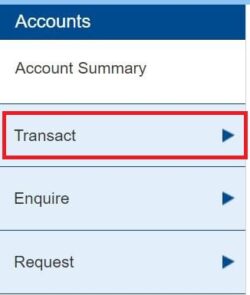

Step 3: Open a Fixed Deposit

After login successfully, click on Transact on the left hand side as highlighted below. This will expand all the option underneath.

You need to select Open Fixed Deposit < Rs 5 Cr as highlighted below if the deposit amount is less than 5 Cr.

You will be redirected to below fixed deposit form where you need to fill all the given below details. First you need to select the type of FD from given three options - Regular Deposit, 5 years Tax Saving Deposit and HealthCover FD. By default, Regular Deposit will be selected. You can select any option as per your requirement. Then you need to select your Savings bank account from where the deposit amount needs to be deducted.

Next you need to select the place of FD. It could be either Home Branch or Others. By default home branch will be selected but if you select Others then you need to select the branch address where you would like to open the term deposit.

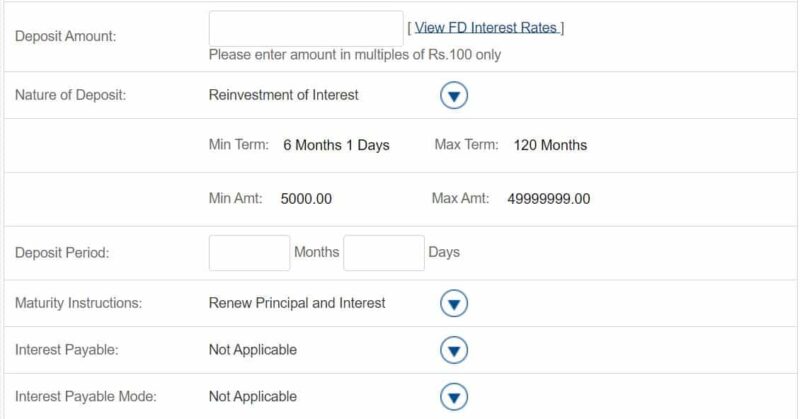

Then fill the Deposit Amount in the multiples of Rs100 and then select the Nature of deposit. For maximum return, always select Reinvestment of interest so that it will get compounded. Then you have to select the deposit period in months and days as specified below.

Next you need to select the maturity instructions as per your requirements. Usually you will see three options in Maturity instructions - Renew Principal and Interest, Renew Principal Only and Do not renew. You can select any option as per your requirement. But if you are looking to credit the amount to your savings bank account post completion of the tenure then select Do not renew option.

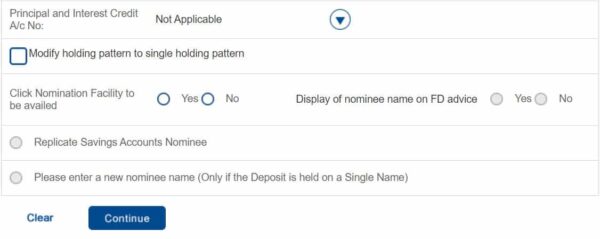

If you scroll down a bit, you then need to provide the nomination details if you would like. Otherwise, you can leave as it is and select No on Click Nomination Facility to be availed. Once everything filled up, click on Continue to proceed.

You will see the summary of all the details given along with the final amount and the rate of interest given on the deposit amount. If everything looks ok then click on Confirm to finally open the fixed deposit account. You will see a Congratulatory message on successful opening of the fixed deposit account. You can check the details in Fixed deposit summary in the Enquire section under Accounts. It will be updated there with all the details shown. That's all you needed to do.