In this article, we will see how to open fixed deposit account in Bank of India online. There are lot of people out there who would like to open a fixed deposit account in Bank of India but does not have enough time to go to bank and open a deposit account. In those cases, opening deposit account through Internet Banking would be a viable option. It just takes few clicks to accomplish the task. Here we will see the steps in detail from a retail user point of view and understand the best scheme that can be used for fixed deposit.

What is Fixed Deposit(FD)

It is a financial investment instrument offered by the Banks or NBFCs guaranteeing a certain amount of interest on a fixed sum of money after a specific period of time. The rate of interest for a fixed deposit always varies and depends on Bank to Bank or NBFCs. But it is always higher than the savings bank of account interest.

How to Open a Fixed Deposit Account in Bank of India(BOI) Online?

Also Read: Why my fixed deposit opening and maturity amount showing same ?

Step 1: Prerequisites

a) You should have a valid Internet banking account.

b) You should have a working PC or Mobile device.

c) You should have an active Internet Connection in your PC or Mobile Device.

Step 2: Login to Your Account

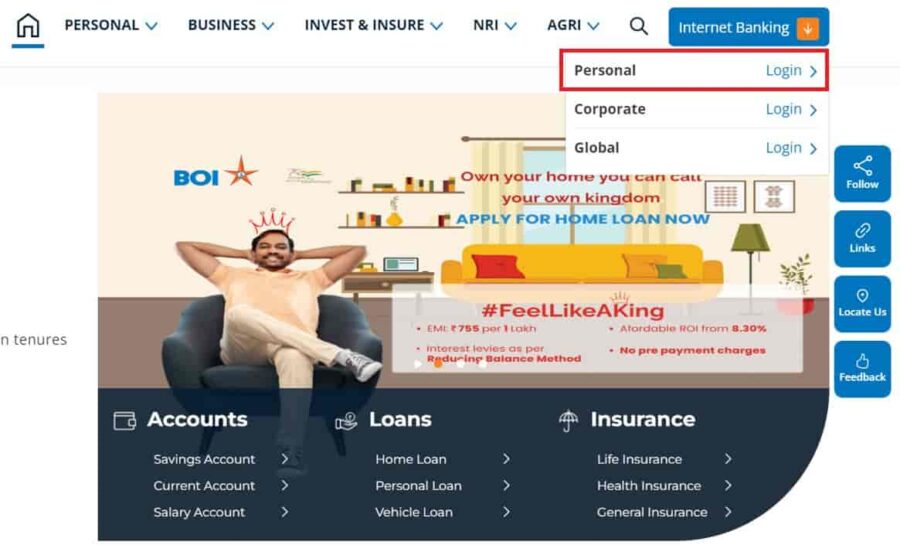

You need to first open your favorite browser and go to Bank of India(BOI) official Internet Banking page.

Here click on Personal Login to login as Retail login. You can also select other option to login depending on the type of login account you have.

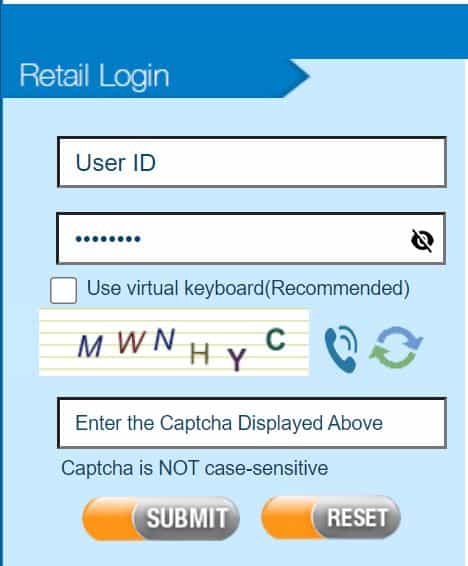

You will be redirected to Retail Login page where you need to provide User ID and Password along with the Captcha. Then click on Submit to login.

Step 3: Open Fixed Deposit

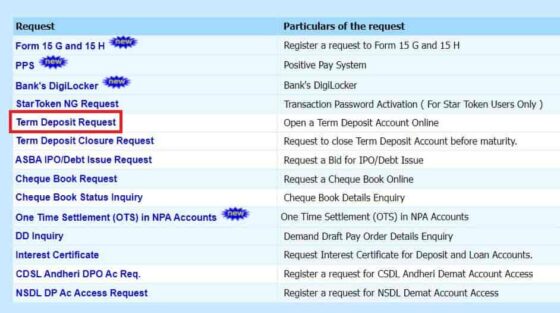

After login successfully to your banking account, go to Requests showing on the top menu bar as highlighted below.

Then click on Term Deposit Request as shown below.

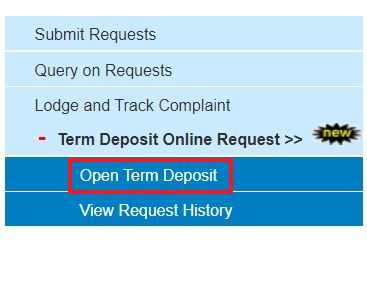

Here you need click on Open Term Deposit as you can see below.

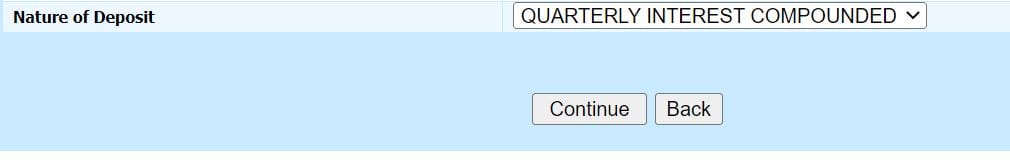

Here you need to make sure your Debit bank account is selected and the nature of deposit should be Quarterly Interest Compounded. You will also have other nature of deposits like Monthly Interest Payable, Quarterly Interest Payable and Short Term Deposit but here you have to choose Quarterly Interest Compounded only to avail the best interest benefits. Then click on Continue to proceed.

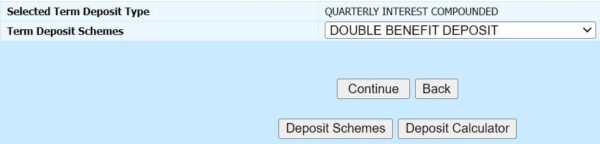

Here you need to select Term Deposit Schemes as Double Benefit Deposit and click on Continue.

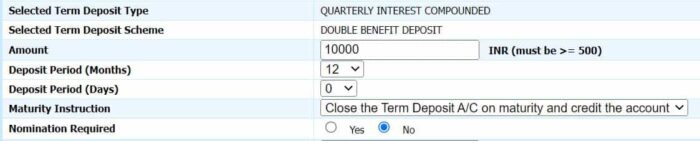

Then you need to provide the details like Amount, Deposit Period(Months), Deposit Period(Days), Maturity Instruction and Nomination Required.

- Amount : This is the total amount which you would like to deposit for certain period of time.

- Deposit Period(Months): This is the time period in months for which the amount would be deposited.

- Deposit Period(Days): This is the time period in number of days for which the given amount would be deposited.

- Maturity Instruction: This option is used to specify the action needs to be taken at the time of maturity of your fixed deposit.

- Nomination Required: This option is used to select nominee in your fixed deposit account.

Once all the above details are provided, click on Continue to provide your transaction password. Then after verifying all the details, finally click on confirm to open your fixed deposit account. You should now be able to see your fixed deposit account under Deposit section. However please note that if you have opened your account on weekend then it will be only reflected in the deposit section from the next working day.