In this article, I will show you how to open FD Account in Axis Bank online using 3 easy steps. Axis bank is the third largest private sector bank in India with a vast retail footprint of over 11000+ ATMs and 4000+ branches across the country. Along with the wide range of investment options it offers, term deposit is one such popular investment option where people can have decent returns.

Usually term deposit are of two types - first in which you deposit once for a fixed period of time, this is called Fixed deposit(FD) and the other one where you deposit a sum of amount every month for a fixed time period, this is called Recurring deposit(RD). While we will look into RD in future articles, here we will see how to open FD account online using just few simple steps.

How to Open FD Account in Axis Bank Online Using 3 Easy Steps

Also Read: How to Close Recurring Deposit(RD) Account Before Maturity in SBI Online

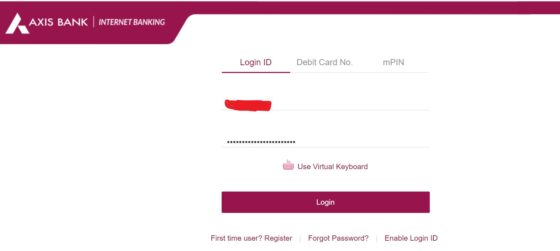

Step 1: Login to Axis Bank

You need to first open the Axis Bank Retail Login page as shown below. Here you will see multiple options to login. You can choose to login using either Login ID or through Debit Card No or through mPIN. Once the credentials are given, Click on Login.

Step 2: Go to FD/RD

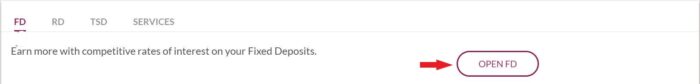

After successful login, you need to tap on FD/RD showing on the left hand side.

By default you will be redirected to FD section. If not, then you can manually tap on FD as shown below.

![]()

Step 3: Open Fixed Deposit(FD)

Here you will see an OPEN FD option as highlighted below. You can click on this option to open the Fixed Deposit page.

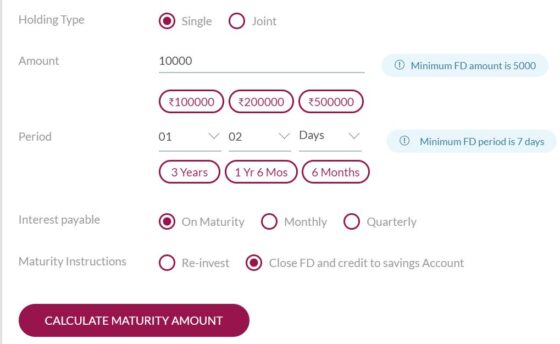

As you can see, to open a FD you need to fill all the details as asked below. You can select your holding as Single or Joint depending on the type of your account and how you would like to open. Then you need to specify the amount that you want to fix for a specific tenure. As you can see this amount should be a minimum of 5000. Next is the time period till which the amount needs to be fixed. Here also as you can see minimum FD period is 7 days.

Next is the Interest Payable means when you want your fixed deposit interest to be paid. You have three options to choose from - On Maturity, Monthly and Quarterly. Here we are choosing On Maturity option. Finally you need to specify the maturity details in which you need to specify if you want to close your FD account and credit the amount to Savings bank account post maturity or if you would like to reinvest the whole amount after completing the deposit time period. After filling all the details, click on CALCULATE MATURITY AMOUNT.

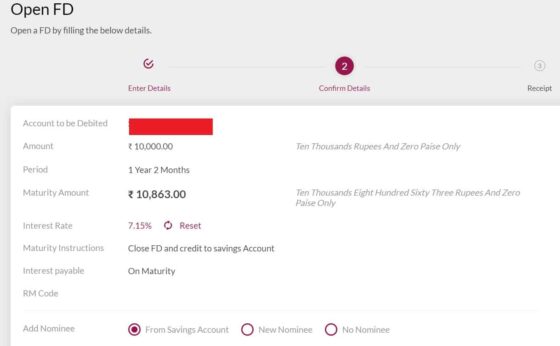

You will see the calculated maturity amount along with Interest rate and other selected information as shown below. You can also provide the nominee details. After verifying all the details, click I have read and accept the Terms and Conditions check box and then finally click on CONFIRM to book the fixed deposit.

NOTE:

After successfully booking the fixed deposit, you can print and save the deposit receipt for future references. That's all you needed to do !!